Capital Market

Tailored Capital Solutions for Growth and Resilience

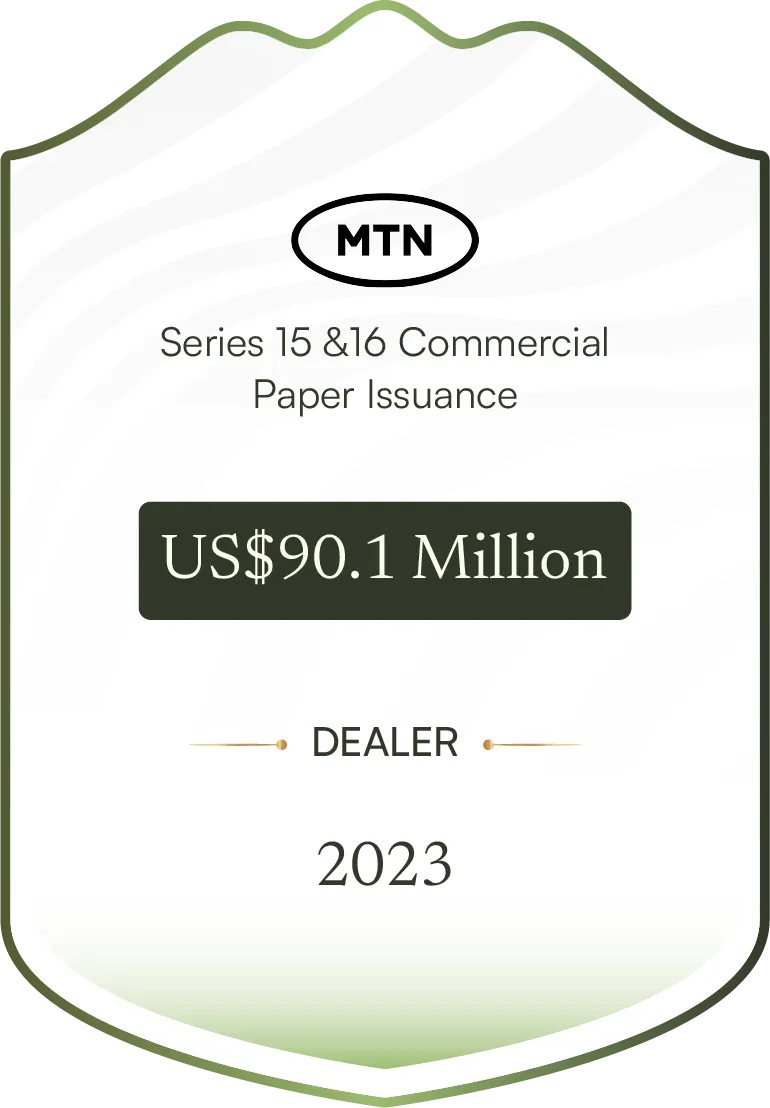

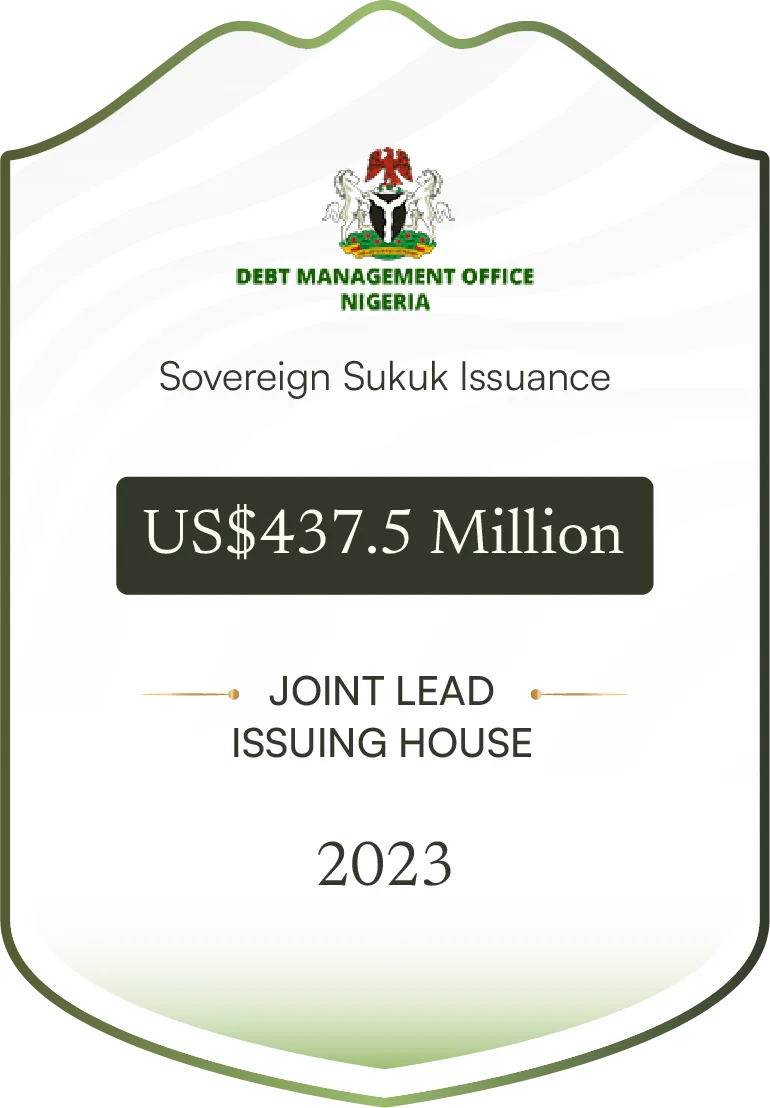

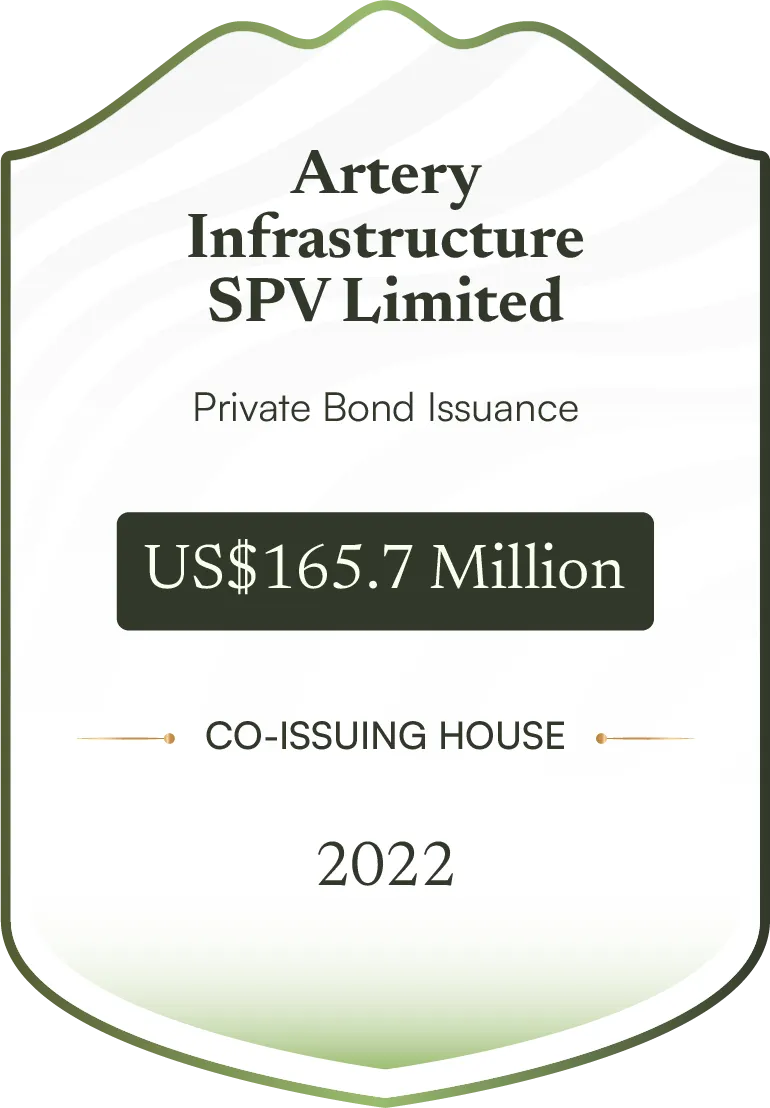

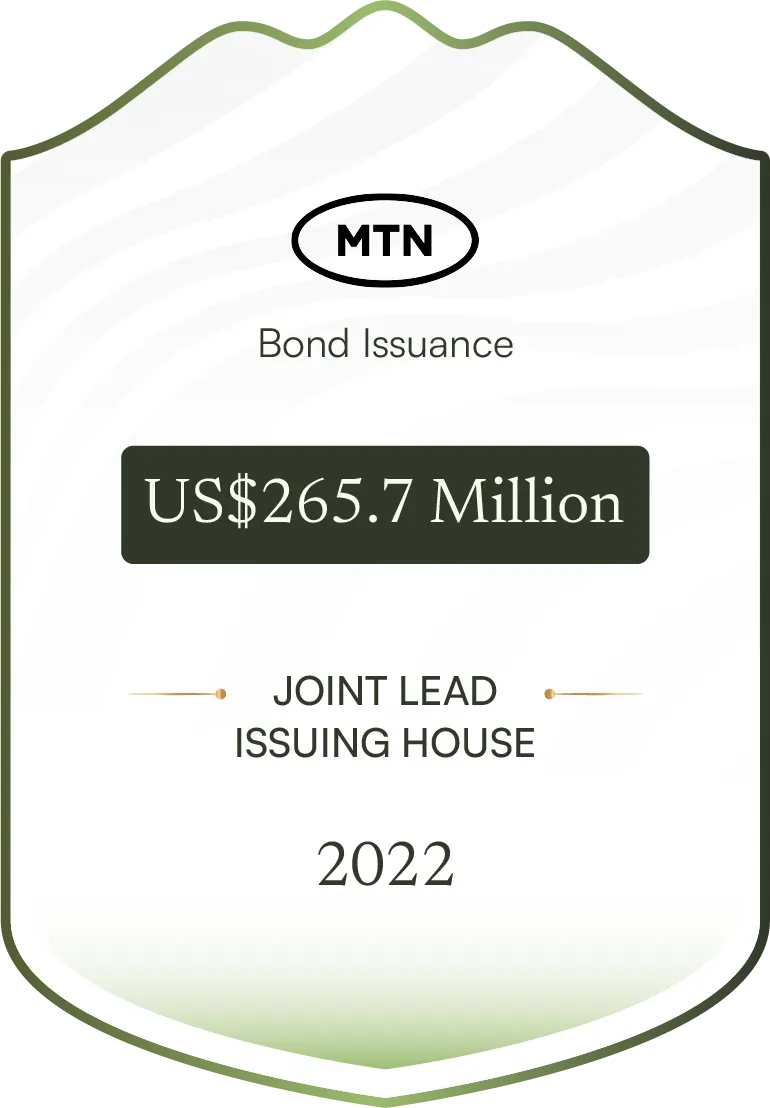

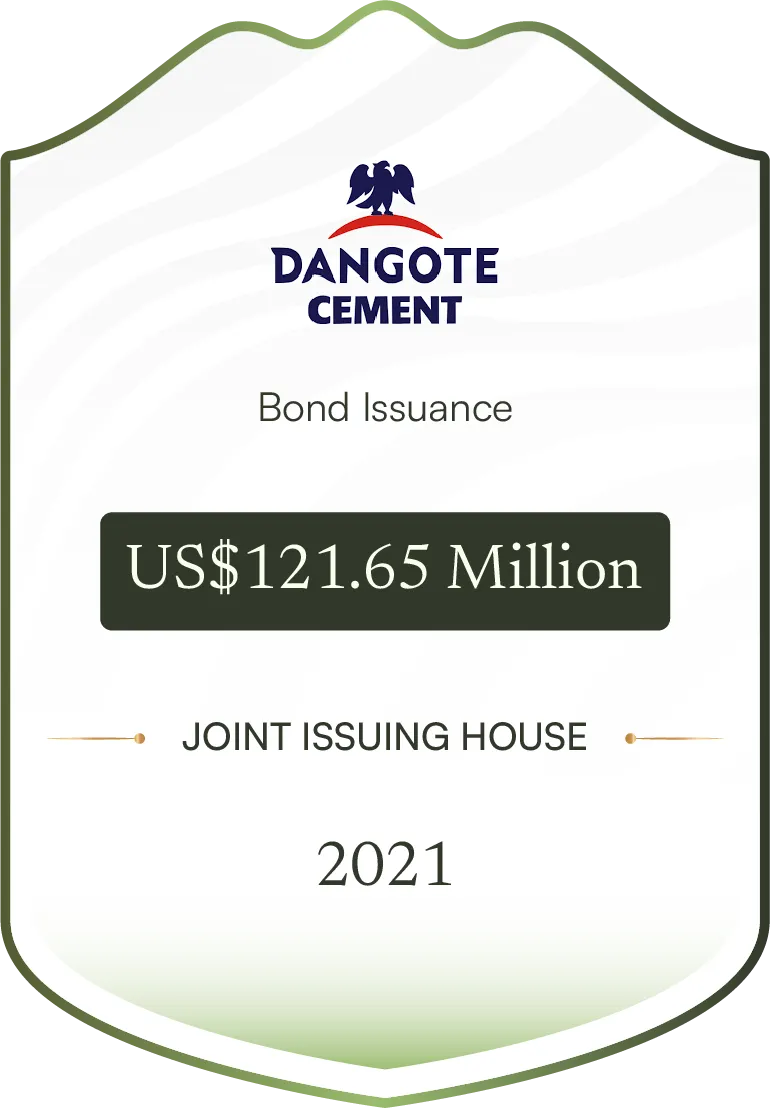

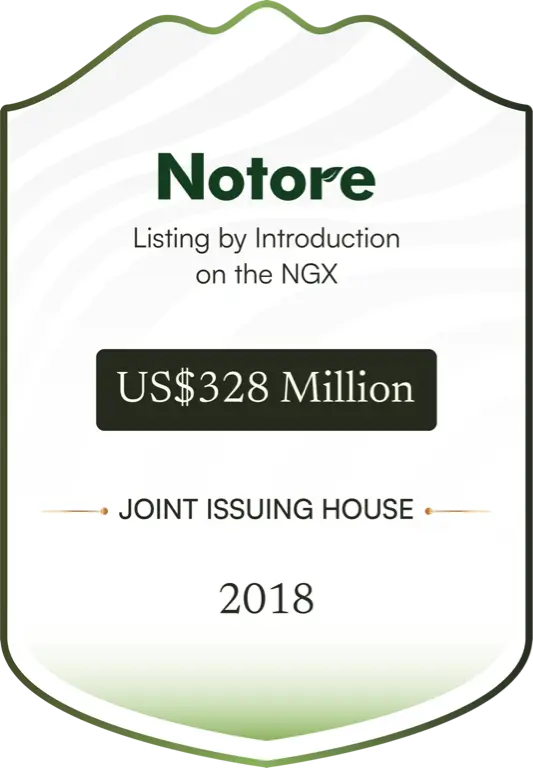

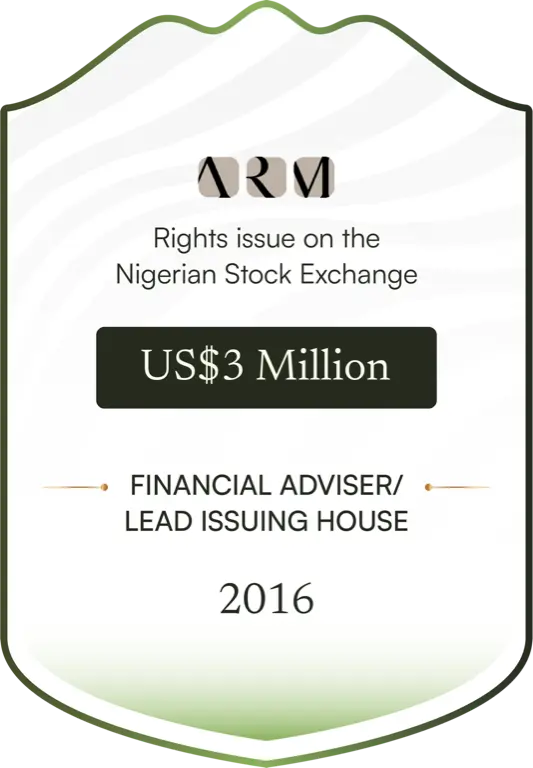

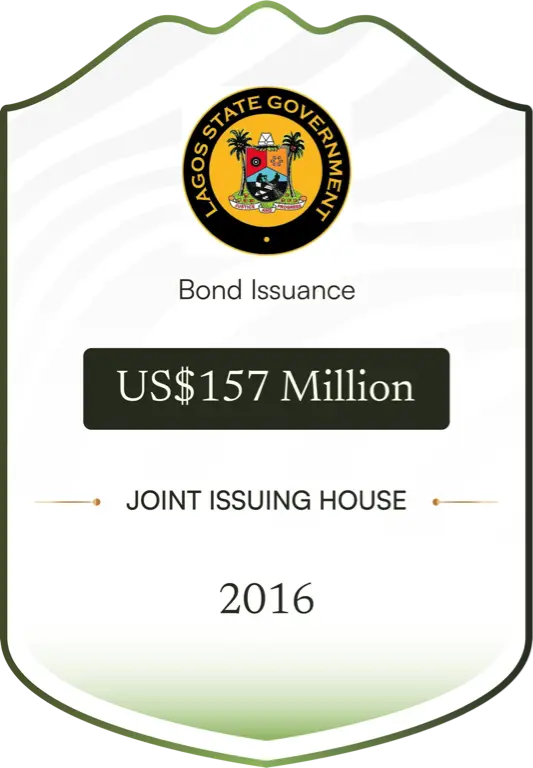

We advise clients on structuring, raising and optimising capital to support strategic growth, manage liquidity and strengthen balance sheets. Our Capital Markets practice spans the full spectrum of debt, equity and hybrid instruments—delivering solutions that consider market realities and drive long-term shareholder value creation.

We work closely with corporates, financial sponsors, governments and family-owned businesses to design financing strategies that are practical, competitive and aligned with evolving investor expectations. Our capital markets execution is anchored on a strong foundation of financial advisory - encompassing capital structure optimisation, cost of capital analysis and funding mix evaluation; supported by the depth of our Capital Markets expertise to deliver optimal results.

Our Products and Services

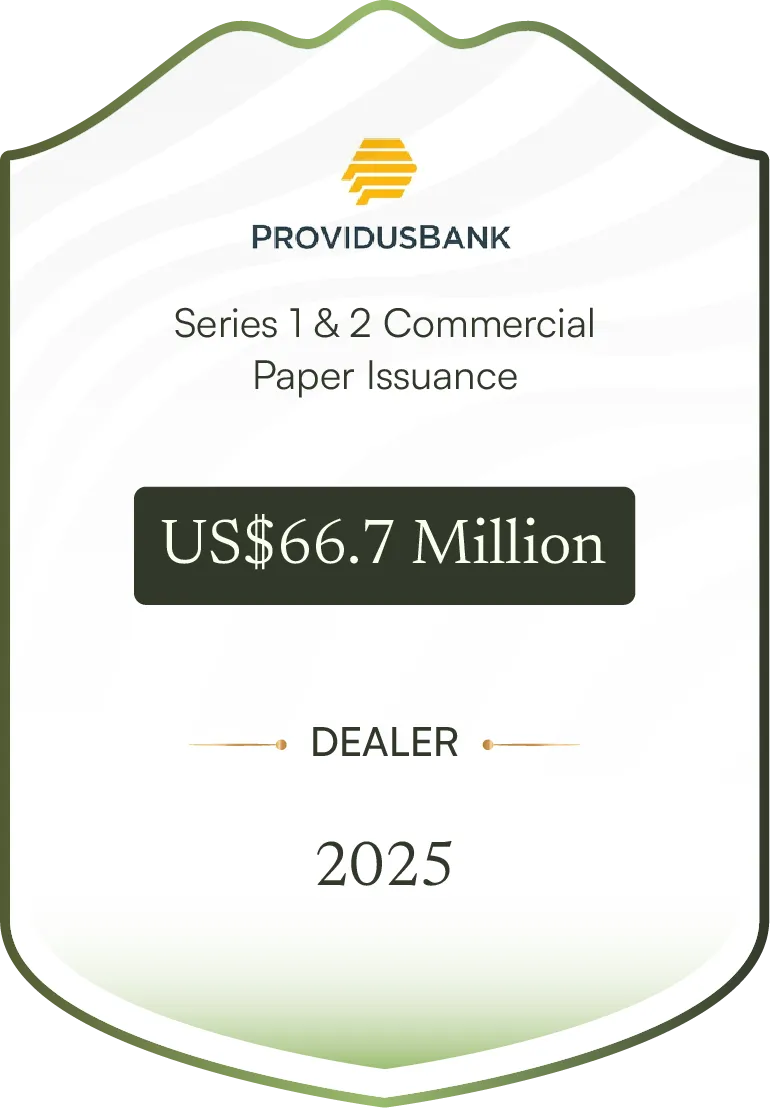

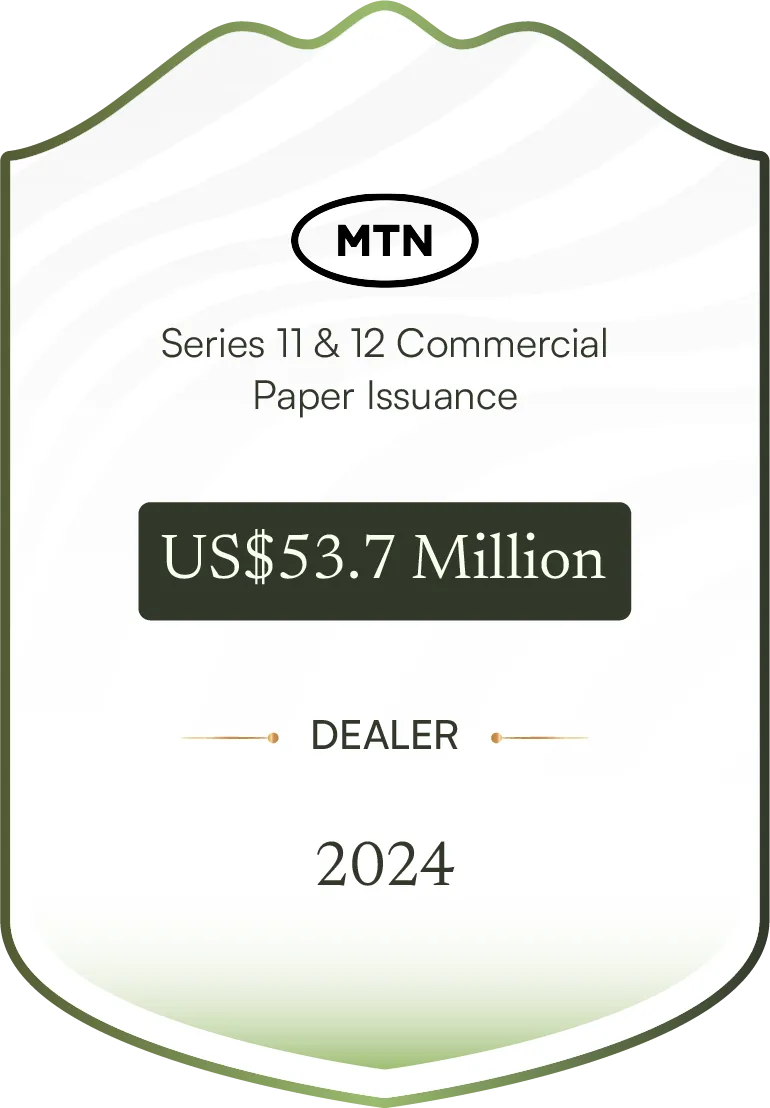

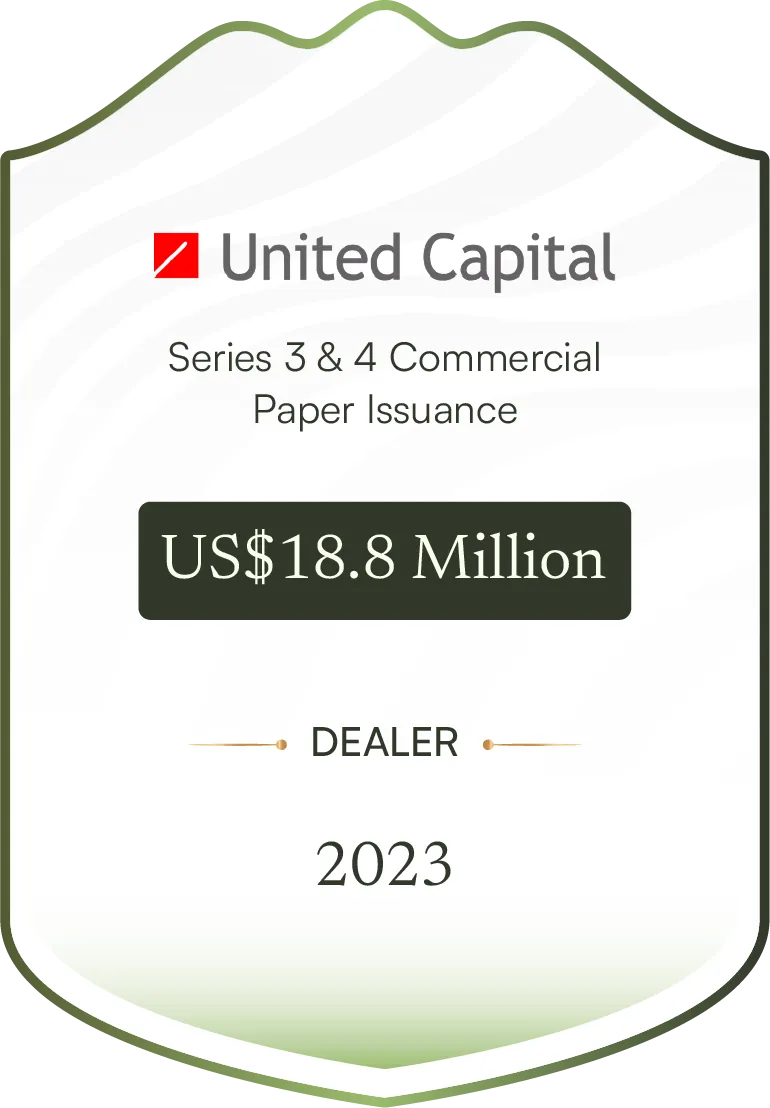

Debt Advisory & Placement

We help clients raise debt capital across the credit spectrum—short and long term – to fund strategic initiatives. We guide the entire process: structuring terms, preparing materials, coordinating key engagement and negotiating key documents.

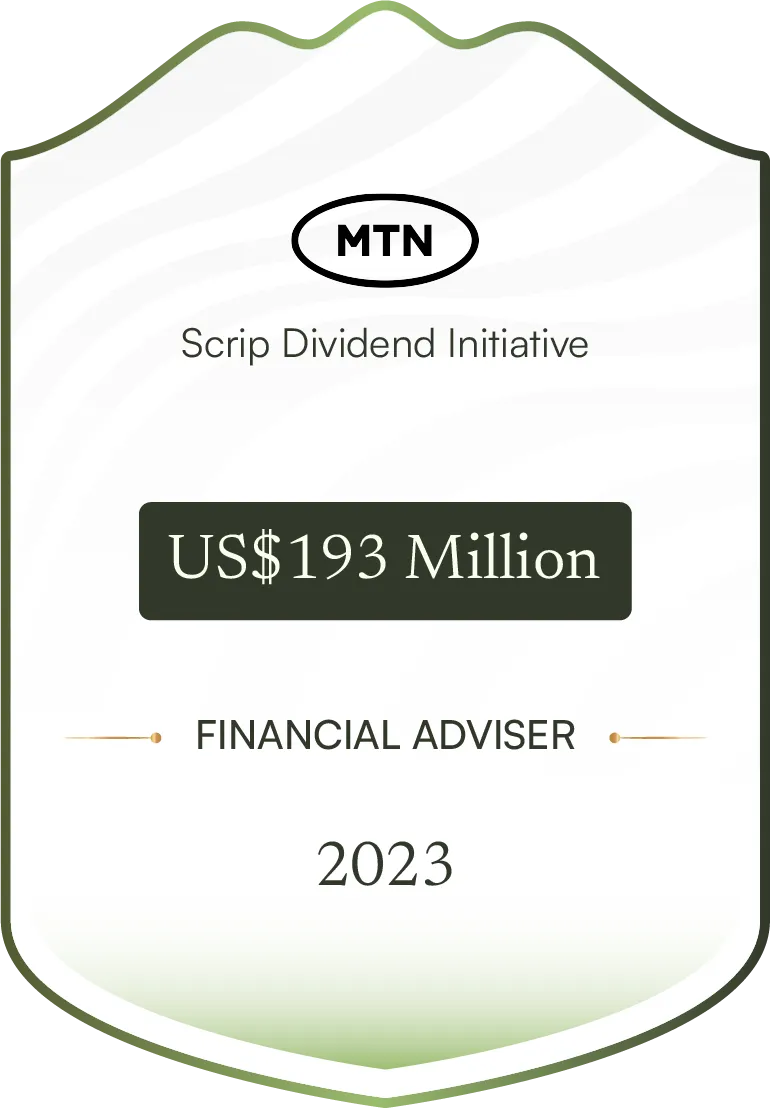

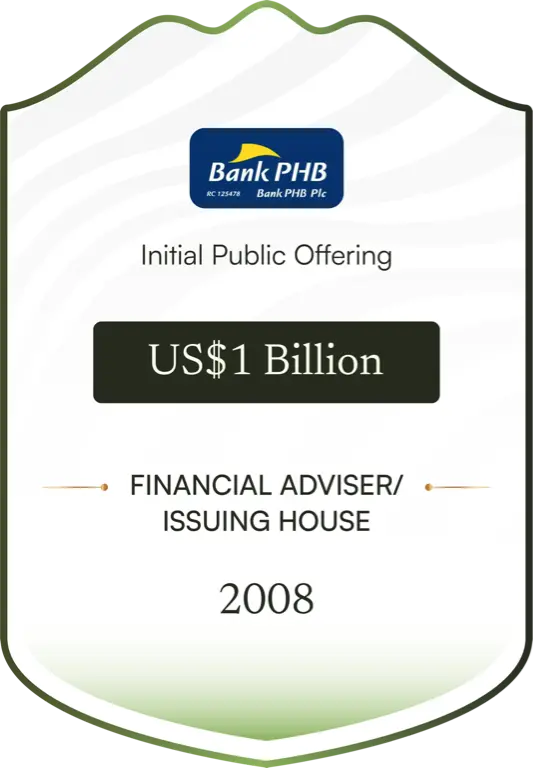

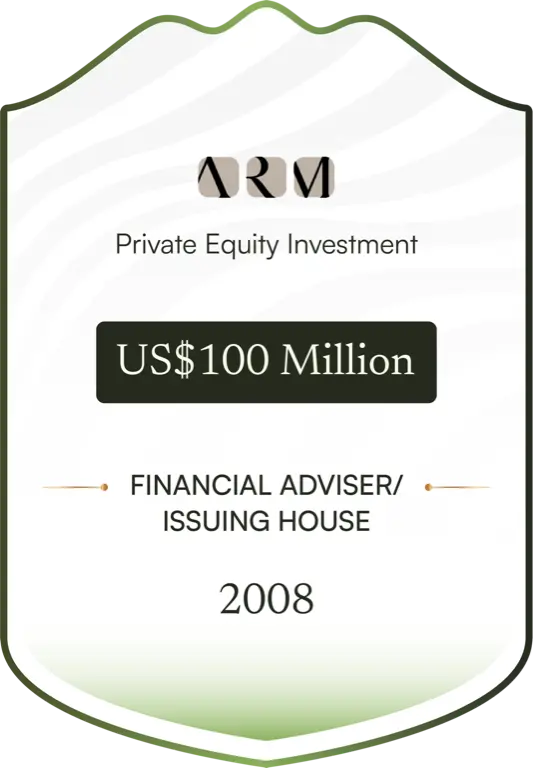

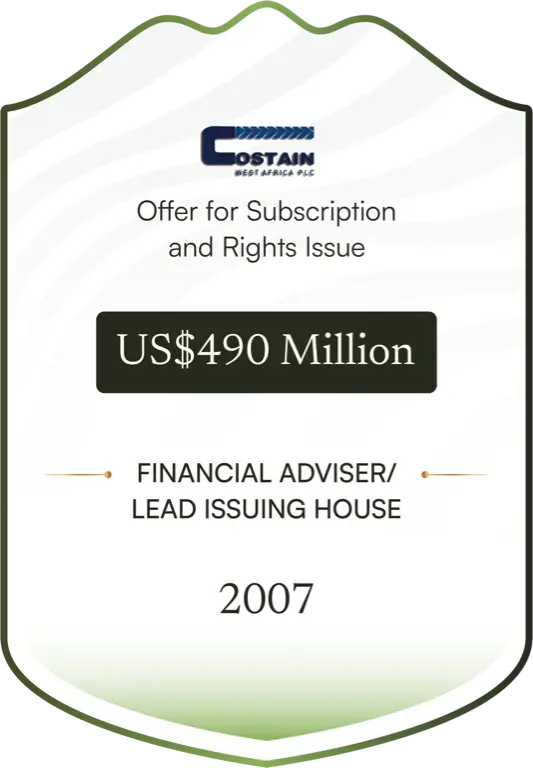

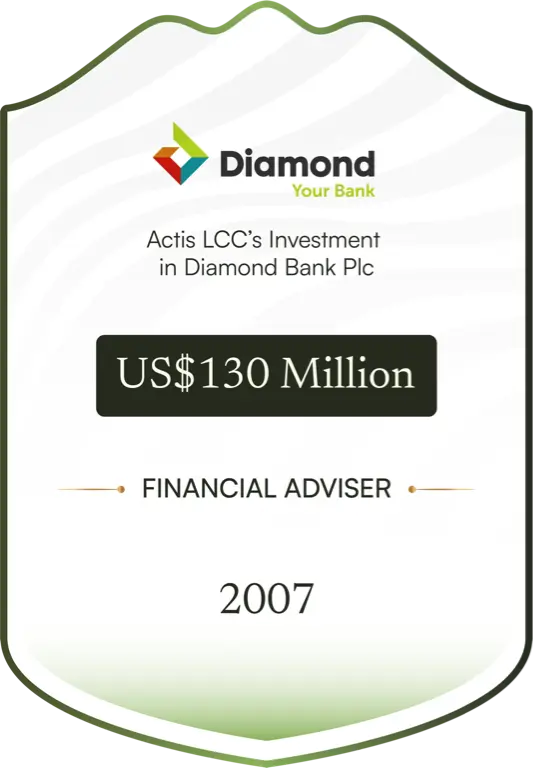

Equity Capital Solutions

We advise on public and private equity raises— including public offers, private placements, rights issues, strategic equity investments, convertible instruments and equity-linked structures. We also support shareholder liquidity events such as scrip dividends, bonus issues and share buy-backs, ensuring alignment between investor appetite and corporate objectives. We also advise on other structures like Real Estate Investment Trusts (REITs) and other equity-type instruments, raising the required capital to meet specified objectives.

Structured & Hybrid Capital

We originate and structure bespoke capital solutions that blend debt and equity characteristics. This includes convertible notes, redeemable preferred equity, mezzanine financing and hybrid securities— designed to provide flexible capital without immediate dilution or rigid covenants.

Vetiva Research

Macro Economic Updates

Our comprehensive macroeconomic reports deliver actionable insights and detailed analysis to help businesses and investors make informed strategic decisions.

Capital Markets

Stay ahead with our timely and in-depth Capital Markets analysis, providing crucial insights and data-driven recommendations for optimal investment strategies.

Market Data

Access real-time market intelligence through our daily and weekly reports, featuring key metrics, trend analysis, and actionable market insights.